UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to Section 240.14a-12 |

Waterstone Financial, Inc. |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 7, 202211, 2024

Dear Fellow Shareholder,

We invite you to attend the virtual Waterstone Financial, Inc. Annual Meeting of Shareholders, which will be held virtuallyat WaterStone Bank SSB, 11200 W. Plank Ct., Wauwatosa, Wisconsin at 9:00 a.m., Central Time, on Tuesday, May 17, 2022.

To participate in the meeting, visit www.cstproxy.com/wsbonline/2022, and enter the 12 digit control number included on your proxy card. You may register for the meeting as early as 9:00 a.m., Central Time, on May 12, 2022. Beneficial investors, who own their investments through a bank or broker, will need to contact Continental Stock Transfer to receive a control number. If you plan to vote at the meeting you will need to have a legal proxy from your bank or broker, or if you would like to join and not vote Continental will issue you a guest control number with proof of ownership. The contact information for Continental Stock Transfer is 1-917-262-2373, or proxy@continentalstock.com.

If you do not wish to participate in the meeting, but you merely wish to listen to the proceedings, we have set up telephone access for those purposes. In that case, please call, toll-free (within the United States and Canada), 1-800-450-7155. If calling from outside the United States or Canada, please call 1-857-999-9155 (standard rates apply). The passcode for listening by telephone is 1567487#.21, 2024.

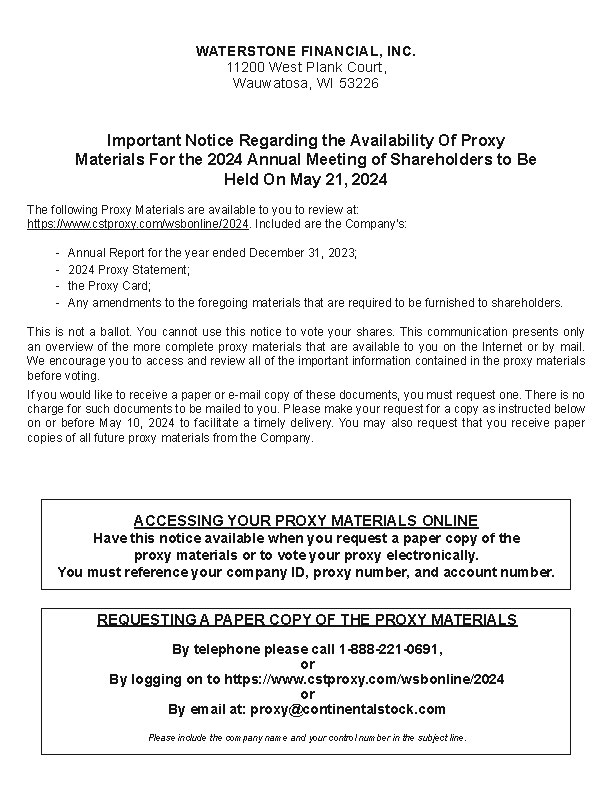

We are furnishing proxy materials to our shareholders over the internet, as permitted by rules adopted by the Securities and Exchange Commission. You may read, print and download our 20212023 Annual Report to Shareholders on Form 10-K and our Proxy Statement at www.cstproxy.com/www.cstproxy.com/wsbonline/2022.2024. On April 7, 2022,11, 2024, we mailed our shareholders a notice containing instructions on how to access these materials and how to vote their shares online. The notice provides instructions on how you can request a paper copy of these materials by mail, by telephone or by e-mail. If you requested your materials via e-mail, the e-mail contains voting instructions and links to the materials on the internet.

You may vote your shares by internet, by telephone, or by regular mail.mail or in person at the Annual Meeting. Instructions regarding the various methods of voting are contained on the notice and on the proxy card.

Proxy Card.

The proxy materials describe the formal business to be transacted at the Annual Meeting. Included in the materials is our Annual Report on Form 10-K, which contains detailed information concerning our activities and operating performance.

On behalf of the board of directors, we request that you vote early as ityour shares now, even if you currently plan to attend the Annual Meeting. This will not prevent you from voting in person, but will assure that your vote is counted if there are any unforeseen disruptions between now and May 17, 2022.counted.

Sincerely,

DOUGLAS S. GORDONWILLIAM F. BRUSS

Chief Executive Officer

WATERSTONE FINANCIAL, INC.

11200 W. Plank Ct.

Wauwatosa, Wisconsin 53226

(414) 761-1000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 17, 202221, 2024.

_____________________________

To the Shareholders of Waterstone Financial, Inc.:

The 20222024 annual meeting of shareholders of Waterstone Financial, Inc. will be held virtually on Tuesday, May 17, 2022,21, 2024 at 9:00 a.m., Central Time, at www.cstproxy.com/wsbonline/2022WaterStone Bank SSB, 11200 W. Plank Ct., Wauwatosa, Wisconsin for the following purposes:

| | (1) | Electing two directors to serve for a term expiring in 2025;2027; |

| | (2) | Ratifying the selection of CliftonLarsonAllenFORVIS, LLP as Waterstone Financial, Inc.’s independent registered public accounting firm; |

| | (3) | (3)Approving an advisory, non-binding resolution to approve the executive compensation described in the Proxy Statement; and

| Approving an advisory, non-binding resolution to approve the executive compensation described in the Proxy Statement; and

|

| | (4) | Transacting such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The board of directors has fixed March 23, 202227, 2024 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and any adjournment thereof. Only shareholders of record at the close of business on that date will be entitled to vote at the annual meeting and any adjournments thereof.

We call your attention to the Proxy Statement accompanying this notice for a more complete statement regarding the matters to be acted upon at the annual meeting. Please read it carefully.

| By Order of the Board of Directors |

| |

| |

| William F. Bruss |

| President and Secretary |

By Order of the Board of Directors

William F. Bruss

Chief Executive Officer

Wauwatosa, Wisconsin

April 7, 2022

11, 2024

PROXY STATEMENT

WATERSTONE FINANCIAL, INC.

11200 W. Plank Ct.

Wauwatosa, Wisconsin 53226

(414) 761-1000

______________________

SOLICITATION AND VOTING

This Proxy Statement and accompanying Proxy Card are furnished to the shareholders of Waterstone Financial, Inc. (“Waterstone Financial” or the “Company”) in connection with the solicitation of proxies by the Waterstone Financial board of directors for use at the annual meeting of shareholders to be held virtually at www.cstproxy.com/wsbonline/2022 onWaterStone Bank SSB, 11200 W. Plank Ct., Wauwatosa, Wisconsin at 9:00 a.m., Central Timeon Tuesday, May 17, 2022,21, 2024, and at any adjournment of the meeting. The 20212023 Annual Report on Form 10‑K is enclosed with the Proxy Statement and contains business and financial information concerning Waterstone Financial. Our proxy materials are being made available to shareholders on or about April 7, 2022.

Record Date and Meeting Information. As a registered stockholder, you received a proxy card, which contains instructions on how to attend the virtual annual meeting, including the website along with your control number. You will need your control number for access. If you do not have your control number, contact our transfer agent, Continental Stock Transfer at (917) 262-2373 or proxy@continentalstock.com.

If your shares of Company common stock are held by a bank, broker or other nominee, you will need to contact your bank, broker or other nominee and obtain a legal proxy. Once you have received your legal proxy, contact Continental Stock Transfer to have a control number generated. The contact information for Continental Stock Transfer is (917) 262-2373, or proxy@continentalstock.com.

A question and answer session will be held during the annual meeting, and shareholders will be able to submit questions prior to the meeting by visiting www.cstproxy.com/wsbonline/2022. Questions may be submitted as early as 9:00 a.m., Central Time, on May 12, 2022, but must be submitted by 12:00 p.m. Central Time on May 16, 2022. The Company will try to answer as many shareholder-submitted questions, as time permits, that comply with the meeting rules of conduct posted on the virtual annual meeting website.11, 2024.

Record Date and Meeting Information. The board of directors has fixed March 23, 202227, 2024 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and any adjournment thereof. Only holders of record of our common stock, the only class of Waterstone Financial stock outstanding as of the close of business on the record date, are entitled to notice of and to vote at the annual meeting. Each share of common stock is entitled to one vote. As of the record date, there were 24,197,13119,916,843 shares of common stock issued and outstanding.

The board of directors of Waterstone Financial knows of no matters to be acted upon at the annual meeting other than as set forth in the notice attached to this Proxy Statement. If any other matters properly come before the annual meeting, or any adjournment thereof, it is the intention of the persons named in the proxy to vote such proxies in accordance with their best judgment on such matters.

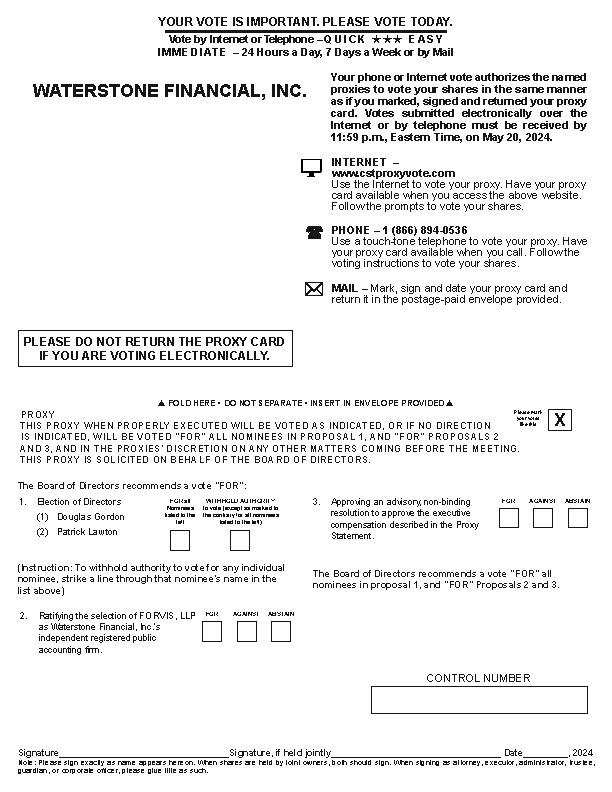

Voting Your Shares. Any shareholder entitled to vote may vote either by mailing a properly executed proxy or online as described in the notice to shareholders and the proxy card. Shares represented by properly executed proxies received by Waterstone Financial will be voted at the annual meeting, or any adjournment thereof, in accordance with the terms of such proxies, unless revoked. Where no instructions are indicated, validly executed proxies will be voted “FOR” the proposals set forth in this Proxy Statement for consideration at the Annual Meeting.

A shareholder may revoke a proxy at any time prior to the time when it is voted by filing a written notice of revocation with our corporate secretary at the address set forth above, by delivering a properly executed proxy bearing a later date, using the internet or telephone voting options explained on the Proxy Card, or by voting virtually at the annual meeting. Virtual attendance at the annual meeting will not in itself constitute revocation of a proxy.Card.

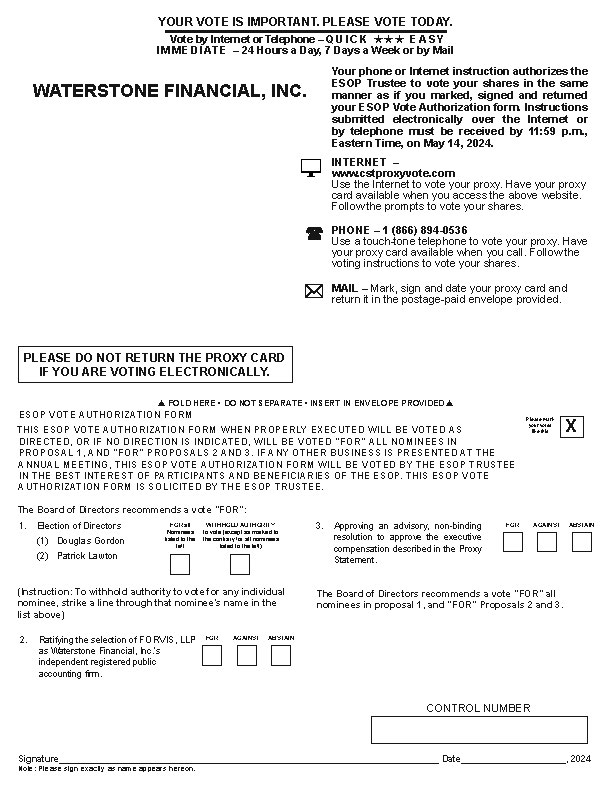

Shares in Employee Plans. Any person who owns shares through an allocation to that person’s account under the WaterStone Bank SSB 2015 Amended and Restated Employee Stock Ownership Plan (the “ESOP”) or who has purchased shares in the Employer Stock Fund in the WaterstoneWaterStone Bank SSB 401(k) Plan (the “401(k) Plan”) will receive separate Vote Authorization Forms to instruct the ESOP Trusteetrustee and 401(k) Plan Trusteetrustee how to vote those shares. The deadline for returning instructions is May 10, 2022.14, 2024. The Trusteetrustee of both the ESOP and 401(k) Plan, Principal Trust Company, will vote shares allocated to a plan participant’s account in accordance with the participant’s instructions. Upon the direction of the plan administrator, the Trusteetrustee will vote the unallocated ESOP shares and any allocated ESOP shares for which no voting instructions are received in the same proportion as allocated shares for which it has received voting instructions. In addition, the Trusteetrustee will vote unvoted shares allocated to participants’ accounts in the 401(k) Plan for which no voting instructions are received in accordance with directions received from the plan administrator.

Quorum and Required Vote. A majority of the votes entitled to be cast by the shares entitled to vote, represented in person or by proxy, will constitute a quorum of shareholders at the annual meeting. Shares for which authority is withheld to vote for director nominees and broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares as to a matter with respect to which the brokers or nominees do not have discretionary power to vote) will be considered present for purposes of establishing a quorum. The inspector of election appointed by the board of directors will count the votes and ballots at the annual meeting.

As to Proposal 1, the election of directors, shareholders may vote “FOR” or “WITHHELD”“WITHHOLD” as to each or all of the nominees. A plurality of the votes cast at the annual meeting by the holders of shares of common stock entitled to vote is required for the election of directors. In other words, the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors in a class to be chosen at the annual meeting. With respect to the election of directors, any shares not voted, whether by withheld authority, broker non-vote or otherwise, will have no effect on the election of directors except to the extent that the failure to vote for an individual results in another individual receiving a comparatively larger number of votes.

As to Proposal 2, the ratification of the independent registered public accounting firm, shareholders may (i) vote “FOR” the ratification; (ii) vote “AGAINST” the ratification; or “AGAINST,” or may(iii) “ABSTAIN” from voting on the matter. The affirmative vote of a majority of the votes cast at the Annual Meeting, without regard to either broker non-votes, or shares as to which the “ABSTAIN” box has been selected on the proxy card, is required to ratify CliftonLarsonAllenFORVIS, LLP as our independent registered public accounting firm for the year ending December 31, 2022.2024.

As to Proposal 3, the advisory, non-binding resolution to approve our executive compensation as described in this Proxy Statement, a shareholder may: (i) vote “FOR” the resolution; (ii) vote “AGAINST” the resolution; or (iii) “ABSTAIN” from voting on the resolution. The affirmative vote of a majority of the votes cast at the Annual Meeting, without regard to either broker non-votes, or shares as to which the “ABSTAIN” box has been selected on the proxy card, is required for the approval of this non-binding resolution. While this vote is required by law, it will neither be binding on Waterstone Financial, Inc. or the board of directors, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on the members of the board of directors.

Expenses and Solicitation. We will pay all expenses incurred in connection with the solicitation of proxies. Proxies will be solicited principally by mail, but may also be solicited by our directors, officers and other employees in person or by telephone, facsimile or other means of communication. Those directors, officers and employees will receive no compensation therefor in addition to their regular compensation, but may be reimbursed for their related out-of-pocket expenses. Brokers, dealers, banks, or their nominees, who hold common stock on behalf of another will be asked to send proxy materials and related documents to the beneficial owners of such stock, and we will reimburse those persons for their reasonable expenses. In addition, we have entered into an agreement with Laurel Hill Advisory Group, LLC to assist in soliciting proxies for the annual meeting and we have agreed to pay them $5,000, plus out-of-pocket expenses, for these services.

Householding. Some banks, brokers, broker-dealers and other similar organizations acting as nominee record holders may be participating in the practice of “householding” proxy materials. This means that only one copy of the notice of meeting and instructions on how to access the proxy materials and the 20212023 Annual Report may have been sent to multiple stockholders in your household. If you would prefer to receive separate copies of these materials for other stockholders in your household, either now or in the future, please contact your bank, broker, broker-dealer or other similar organization serving as your nominee.

Upon written notice to Mark R. Gerke, Chief Financial Officer, Waterstone Financial, Inc., 11200 W. Plank Ct., Wauwatosa, Wisconsin 53226, or via telephone at (414) 761-1000, we will promptly provide separate copies of the 20212023 Annual Report and/or this Proxy Statement. Stockholders sharing an address who are receiving multiple copies of this Proxy Statement and/or the 20212023 Annual Report and who wish to receive a single copy of these materials in the future will need to contact their bank, broker, broker-dealer or other similar organization serving as their nominee to request that only a single copy of each document be mailed to all stockholders at the shared address in the future.

Limitations on Voting. The Company’s Articles of Incorporation provide that, subject to certain exceptions, record owners of the Company’s common stock that is beneficially owned by a person who beneficially owns in excess of 10% of the Company’s outstanding shares are not entitled to any vote any of the shares held in excess of the 10% limit.

STOCK OWNERSHIP

The following table shows the amount of our common stock held by groups who are beneficial owner of more than 5% of our shares as of December 31, 2021,2023, based upon information filed with the SEC. The “Percent of All Common Stock Outstanding” reflects the percentage of our common stock outstanding as of March 23, 2022.27, 2024.

Name of Beneficial Owner | | Total Shares Beneficially Owned | | | Percent of All Common Stock Outstanding |

Renaissance Technologies LLC | | 1,791,703 | (1) | | 7.4% |

Renaissance Technologies Holdings Corporation | | | | | |

800 Third Avenue | | | | | |

New York, New York 10022 | | | | | |

Dimensional Fund Advisors LP | | 1,856,166 | (2) | | 7.7% |

Building One | | | | | |

6300 Bee Cave Road | | | | | |

Austin, Texas 78746 | | | | | |

BlackRock, Inc. | | 1,822,026 | (3) | | 7.5% |

55 East 52nd Street | | | | | |

New York, New York 10055 | | | | | |

Delaware Charter Guarantee & Trust Company dba Principal Trust Company as | | 2,396,067 | (4) | | 9.9% |

Trustee for the 2010 Amended and Restated Waterstone Bank SSB Employee | | | | | |

Stock Ownership Plan and the Waterstone Bank 401(k) Plan | | | | | |

1013 Centre Road Suite 300 | | | | | |

Wilmington, Delaware 19805-1265 | | | | | |

Name of Beneficial Owner | Total Shares Beneficially Owned | Percent of All Common Stock Outstanding |

Dimensional Fund Advisors LP Building One 6300 Bee Cave Road Austin, Texas 78746 | 1,652,359 (1) | 8.3% |

BlackRock, Inc. 55 East 52nd Street New York, New York 10055 | 1,671,665 (2) | 8.4% |

Renaissance Technologies LLC Renaissance Technologies Holdings Corporation 800 Third Avenue New York, New York 10022 | 1,273,136 (3) | 6.4% |

Delaware Charter Guarantee & Trust Company dba Principal Trust Company as Trustee for the 2010 Amended and Restated Waterstone Bank SSB Employee Stock Ownership Plan and the Waterstone Bank 401(k) Plan 1013 Centre Road Suite 300 Wilmington, Delaware 19805-1265 | 2,275,957 (4) | 11.4% |

| (1) | Renaissance Technologies LLCDimensional Fund Advisors LP reported ownership as of December 31, 2021,2023, on behalf of itself and certain subsidiaries. It reported that it had sole dispositive power for 1,791,7031,652,359 shares and shared dispositive power for no shares. It further reported that it had sole voting power for 1,610,9161,623,168 shares and shared voting power for no shares.

|

| (2) | Dimensional Fund Advisors LPBlackRock, Inc. reported ownership as of December 31, 2021,2023, on behalf of itself and certain subsidiaries. It reported that it had sole dispositive power for 1,856,1661,671,665 shares and shared dispositive power for no shares. It further reported that it had sole voting power for 1,812,0351,646,460 shares and shared voting power for no shares.

|

| (3) | BlackRock, Inc.Renaissance Technologies LLC reported ownership as of December 31, 2021,2023, on behalf of itself and certain subsidiaries. It reported that it had sole dispositive power for 1,822,0261,273,136 shares and shared dispositive power for no shares. It further reported that it had sole voting power for 1,731,7071,273,136 shares and shared voting power for no shares.

|

| (4) | Delaware Charter Guarantee & Trust Company dba Principal Trust Company as Trustee for the 2015 Amended and Restated WaterStone Bank SSB Employee Stock Ownership Plan and the WaterStone Bank SSB 401(k) Plan reported ownership as of December 31, 2021,2023, on behalf of the 2015 Amended and Restated WaterStone Bank SSB Employee Stock Ownership Plan and the WaterStone Bank SSB 401(k) Plan. It reported that it had shared dispositive power for 2,396,0672,275,957 shares and sole dispositive power for no shares. It further reported that it had shared voting power for 2,396,0672,275,957 shares and sole voting power for no shares. |

The following table shows the amount of our common stock beneficially owned by each of our directors, executive officers and directors and executive officers as a group, as of March 23, 2022.27, 2024. Unless otherwise noted, the persons listed have sole voting and dispositive power over their shares.

Name of Beneficial Owner | | Shares Owned Directly | | | Shares Owned Indirectly(1) | | | Stock Options Exercisable within 60 Days of Record Date | | | Total Shares Beneficially Owned | | | Percent of All Shares Outstanding | | Shares Owned Directly | Shares Owned Indirectly (1) | Stock Options Exercisable within 60 Days of Record Date | Total Shares Beneficially Owned | Percent of All Shares Outstanding |

Ellen S. Bartel | | | 15,000 | | | | - | | | | 12,500 | | | | 27,500 | | | | * | | 15,000 | - | 25,000 | 40,000 | * |

William F. Bruss | | | 31,668 | | | | 66,512 | | | | - | | | | 98,180 | | | | * | | 36,051 | 74,529 | - | 110,580 | * |

Thomas E. Dalum(2) | | | 38,531 | | | | 61,596 | | | | 66,719 | | | | 166,846 | | | | * | | |

Mark R. Gerke | | | 30,858 | | | | 30,557 | | | | 15,000 | | | | 76,415 | | | | * | | 36,264 | 37,752 | 15,000 | 89,016 | * |

Julie A. Glynn | | | 3,492 | | | | 6,961 | | | | 16,000 | | | | 26,453 | | | | * | | 10,743 | 13,735 | 20,000 | 44,478 | * |

Douglas S. Gordon | | | 548,061 | | | | 68,296 | | | | - | | | | 616,357 | | | | 2.6 | % | 556,889 | 75,294 | - | 632,183 | 3.2% |

Ryan J. Gordon | | 8,585 | 36,035 | 10,000 | 54,620 | * |

Michael L. Hansen | | | 79,872 | | | | 186,541 | | | | - | | | | 266,413 | | | | 1.1 | % | 79,872 | 186,541 | 12,500 | 278,913 | 1.4% |

Patrick S. Lawton | | | 49,131 | | | | 10,000 | | | | 25,000 | | | | 84,131 | | | | * | | 49,131 | 10,000 | 37,500 | 96,631 | * |

Jeffrey R. McGuiness | | | 7,132 | | | | - | | | | - | | | | 7,132 | | | | * | | 3,842 | - | - | 3,842 | * |

Kristine A. Rappé | | | 27,318 | | | | - | | | | 87,500 | | | | 114,818 | | | | * | | 27,318 | - | 100,000 | 127,318 | * |

Stephen J. Schmidt | | | 70,078 | | | | - | | | | 87,500 | | | | 157,578 | | | | * | | 70,078 | - | 100,000 | 170,078 | * |

Derek L. Tyus | | | 6,440 | | | | - | | | | - | | | | 6,440 | | | | * | | 6,440 | - | - | 6,440 | * |

All Directors and Executive Officers as a Group | | | 907,581 | | | | 430,463 | | | | 310,219 | | | | 1,648,263 | | | | 6.7 | % | 900,213 | 433,886 | 320,000 | 1,654,099 | 8.3% |

______________________

| (1) | Number of shares with sole voting and dispositive power: Mr. Bruss – 66,512;74,529; Mr. Gerke – 30,557;37,752; Mr. R. Gordon – 36,035; Ms. Glynn – 6,961;13,735; Mr. D. Gordon – 68,296.75,294. Number of shares with shared voting and dispositive power ;power; Mr. DalumHansen – 61,596;186,541; Mr. HansenLawton – 186,541; Mr. Lawton – 10,000. |

(2)

| Mr. Dalum did not stand for re-election in 2022. Accordingly, his service to the Board will terminate at the conclusion of the 2022 Annual Meeting on May 17, 2022.

|

PROPOSAL 1 – THE ELECTION OF DIRECTORS

Effective upon completion of the annual meeting, Waterstone Financial’s board of directors will consistconsists of seven members. Our bylaws provide that approximately one-third of the directors are to be elected annually. Directors of Waterstone Financial are generally elected to serve for a three-year period and until their respective successors have been duly elected and qualified. Directors Ellen S. BartelDouglas Gordon and Kristine A. Rappé,Patrick Lawton, whose terms expire at the annual meeting, are being nominated for re-election as directors, each for a term expiring at the 20252027 annual meeting of shareholders. Shares represented by proxies will be voted FOR the election of the nominees unless otherwise specified by the executing shareholder. If a nominee declines or is unable to act as a director, proxies may be voted with discretionary authority for a substitute nominee designated by the board. Except as indicated herein, there are no arrangements or understandings between any nominee and any other person pursuant to which such nominee was selected.

The following details include for each of our nominees and directors: their age as of December 31, 2021;2023; the year in which they first became a director of WaterStone Bank, the operating subsidiary of the Company; the year that their term expires; and their business experience for at least the past five years. The members of the Company’s board of directors are the same as the members of the board of directors of WaterStone Bank. None of the directors listed below currently serves as a director, or served as a director during the past five years, of a publicly-held entity (other than Waterstone Financial). The following also includes the particular experience, qualifications, attributes, or skills considered by the Nominating and Corporate Governance Committee that led the board of directors to conclude that such person should serve as a director of Waterstone Financial. The mailing address for each person listed is 11200 W. Plank Ct., Wauwatosa, Wisconsin 53226. The board of directors unanimously recommends that shareholders vote FOR the election of the director nominees listed below.

Name and Age | | Principal Occupation and Business Experience | | Director Since (1) |

| | | | | |

| | Nominees for terms expiring in 20252027 | | |

Douglas S. Gordon, 66 | | Mr. Gordon is the former Chief Executive Officer of Waterstone Financial and WaterStone Bank, beginning in 2007 to January 2024; President of Waterstone Financial and WaterStone Bank from 2007 to 2022, and Chief Operating Officer of WaterStone Bank from 2005 to 2007; real estate investor. Mr. Gordon brings extensive prior banking experience as an executive officer at M&I Bank and at Security Savings Bank. He has extensive firsthand knowledge and experience with our lending markets and our customers. Mr. Gordon has a B.A. from the University of Wisconsin – Parkside and an M.B.A. from Marquette University. Mr. Gordon is the father of Ryan J. Gordon. | | 2005 |

| | | | | |

Patrick S. Lawton, 67 | | Mr. Lawton is the Managing Director of Fixed Income Capital Markets for Baird. Mr. Lawton is also a member of Baird’s board of directors. As a Baird Managing Director, Mr. Lawton brings his investment portfolio expertise to the board of directors. Mr. Lawton has a B.S.B.A. and an M.B.A. from Marquette University. | | 2000 |

| | | | |

| | Continuing Directors – Terms expiring in 2025 | | |

Ellen S. Bartel, 6769 | | Ms. Bartel is the former President of Divine Savior Holy Angels (DSHA) High School (Milwaukee, Wisconsin) from 1998 until 2018, where she achieved significant improvements in DSHA’s curriculum, facilities, financial infrastructure, image, and reputation. Ms. Bartel balanced DSHA’s budget for 18 consecutive years, oversaw endowment growth from under $1 million to over $14 million, and developed recruitment strategies resulting in an incoming class wait list for 19 consecutive years. Prior to her employment at DSHA, Ms. Bartel held several positions at Alverno College (Milwaukee, Wisconsin) (1986 to 1997), with the most recent being Vice President of Institutional Advancement from 1994 to 1997. Ms. Bartel’s experience overseeing a large educational institution provides the board of directors with significant perspective on financial management and human resources matters. Ms. Bartel has a B.A. and an M.S.A. from the University of Notre Dame. | | 2013 |

| | | | | |

Kristine A. Rappé, 6567 | | Ms. Rappé is the former Senior Vice President and Chief Administrative Officer of WEC Energy Group (2004 to 2012). Her roles at WEC Energy Group also included Vice President and Corporate Secretary (2001 to 2004) and Vice President of Customer Services (1994 to 2001). In these roles, Ms. Rappé had responsibility for shared services including information technology, human resources, supply chain management, business continuity/corporate security, and the WEC Foundation. Ms. Rappé’s experience overseeing a large corporate entity provides the board of directors with significant perspective on financial management and human resources matters, and she has a long-standing history of community involvement and public service. Ms. Rappé has an M.A. from Northeastern University and a B.A. from the University of Wisconsin – Oshkosh. | | 2013 |

| | | | | |

| | | Continuing Directors – Terms expiring in 20232026 | | |

| | | | |

Michael L. Hansen, 7073 | | Mr. Hansen is a business investor who currently holds significant ownership interests in Jacsten Holdings LLC and Mid-States Contracting, Inc.LLC. In addition to extensive entrepreneurial experience, Mr. Hansen is a C.P.A. with 13 years of audit and tax experience at an international public accounting firm. Mr. Hansen brings this experience to the board of directors and to the Audit Committee in particular. Mr. Hansen has a B.B.A. from the University of Notre Dame. | | 2003 |

| | | | | |

Stephen J. Schmidt, 6062 | | Mr. Schmidt is the President of Schmidt and Bartelt Funeral and Cremation Services. Mr. Schmidt has entrepreneurial experience and extensive community relationships throughout the communities served by WaterStone Bank. Mr. Schmidt has an Associate’s Degree from the New England Institute and a B.A. from the University of Wisconsin – Stevens Point. | | 2002 |

| | | | |

| | | | |

Derek L. Tyus, 5254 | | Mr. Tyus currently serves as Executive Vice President and Chief Financial Officer of Versiti, Inc., a national leader in innovative blood health solutions. Before joining Versiti, Inc. in 2024, Mr. Tyus was Senior Vice President and Chief Investment Officer of West Bend Mutual Insurance Company. He hashad been with West Bend since 2016. Before joining West Bend, Mr. Tyus was a director for Northwestern Mutual Wealth Management Company. He hasMr. Tyus had been in the insurance industry for 22over 20 years, holding investment positions in private debt and equity, real estate, wealth management as well as strategy and administration. Mr. Tyus is a graduate of Marquette University and received his M.B.A. from the Ross School of Business at the University of Michigan. | | 2021 |

| | Continuing Directors – Terms expiring in 2024 | | |

| | | | |

Douglas S.

Gordon, 64(1)

| | Mr. Gordon isIndicates the Chief Executive Officer of Waterstone Financial and WaterStone Bank, beginning in 2007; President of Waterstone Financial and WaterStone Bank from 2007 to 2022, and Chief Operating Officer of WaterStone Bank from 2005 to 2007; real estate investor. Mr. Gordon brings extensive prior banking experience as an executive officer at M&I Bank and at Security Savings Bank. He has extensive firsthand knowledge and experience with our lending markets and our customers. Mr. Gordon has a B.A. fromdate when the University of Wisconsin – Parkside and an M.B.A. from Marquette University.

| | 2005

|

| | | | |

Patrick S.

Lawton, 65

| | Mr. Lawton is the Managing Director of Fixed Income Capital Markets for Baird. Mr. Lawton is also a member of Baird’s board of directors. As a Baird Managing Director, Mr. Lawton brings his investment portfolio expertisedirector was first elected to the board of directors. Mr. Lawton has a B.S.B.A. and an M.B.A. from Marquette University.

| | 2000

|

(1)

| Indicates the date when the director was first elected to the board of WaterStone Bank. Messrs. Lawton, Hansen, Schmidt and Gordon became directors of Waterstone Financial’s predecessor federal corporation in 2005. Ms. Bartel and Ms. Rappé became directors of Waterstone Financial’s predecessor federal corporationFinancial in 2005. Ms. Bartel and Ms. Rappé2014. Mr. Tyus became directorsa director of Waterstone Financial in 2014. Mr. Tyus became a director of Waterstone Financial in 2021.

|

Executive Officers

Information regarding our named executive officers (“Named Executive Officers” or “NEOs”) who are not directors of Waterstone Financial is set forth in the following table. Except as noted below, each of these individuals has held that position for at least the past five years.

Name and Age | | Offices and Positions with Waterstone Financial and WaterStone Bank | | Executive

Officer

Since |

William F. Bruss, 5254 | | Chief Executive Officer since 2024. President since January 2022, Chief Operating Officer (appointed 2013),from 2013 through 2023, General Counsel and Secretary, Waterstone Financial and WaterStone BankBank. | | 2005 |

Mark R. Gerke, 4749 | | Executive Vice President since January 2020, Chief Financial Officer since 2016, Chief Accounting Officer (appointed 2014),since 2014, Senior Vice President, Waterstone Financial and WaterStone Bank since 2014, Controller 2005 to 20162016. | | 2016 |

Julie A. Glynn, 5860 | | Executive Vice President since January 2022, Chief Retail Officer of WaterStone Bank since March 2018, Senior Vice President - District Manager of Associated Bank since 20132013. | | 2018 |

JeffRyan J. Gordon, 37

Jeffrey R. McGuiness, 5658 | | Executive Vice President/Chief Credit Officer since January 2022, Vice President/Chief Credit Officer 2018 to 2022, Credit Officer 2015 to 2018, Lead Credit Analyst 2012 to 2015, Sr. Credit Analyst 2010 to 2012. Mr. Gordon is the son of Douglas S. Gordon. President and Chief Executive Officer of Waterstone Mortgage Corporation since November 2020. Prior to his role with Waterstone Mortgage Corporation, Chief Sales Officer, Embrace Home Loans – 2015 through November 2020, Chief Executive Officer, Lenders One – 2012 to 2015. | | 2022 2020 |

Meetings and Committees

The board of directors of Waterstone Financial met 12 times during the year ended December 31, 20212023 on behalf of Waterstone Financial and 12 times in their capacity as directors of WaterStone Bank. The board of directors consists of a majority of “independent directors” within the meaning of the NASDAQ corporate governance listing standards. The board of directors determines the independence of each director in accordance with NASDAQ Stock Market rules, which include all elements of independence as set forth in the listing requirements for NASDAQ securities. The board of directors has determined that Directors Bartel, Dalum, Hansen, Lawton, Rappé, Schmidt and Tyus are “independent” directors within the meaning of such standards. In evaluating the independence of our independent directors, we found no transactions between us and our independent directors that are not required to be reported in this Proxy Statement and that had an impact on our determination as to the independence of our directors. Additionally, the independent directors regularly meet without management or non-independent directors present. No member of the board of directors or any committee thereof attended fewer than 75% of the aggregate of: (i) the total number of meetings of the board of directors (held during the period for which each director has been a director); and (ii) the total number of meetings held by all committees of the board of directors on which he or she served (during the periods that he or she served).

We conduct business through meetings of the Company’s and Bank’s boards of directors and their committees. The boards of directors of the Company and the Bank have established standing committees discussed below. The standing committees of the Company include an Audit Committee, Compensation Committee, Executive Committee and a Nominating and Corporate Governance Committee. Each of these committees operates under a written charter available on the Company’s website at www.wsbonline.com.

The following table details the composition of our board committees, eachas of whichDecember 31, 2023. Each committee is composed entirely of independent directors.

Director | Audit Committee | Compensation Committee | Executive Committee | Nominating and Corporate Governance Committee |

Ellen S. Bartel | X | X | | ChairCo-Chair

|

Thomas E Dalum

| X

| Chair

| | |

Michael L. Hansen | Chair | | X | X |

Patrick S. Lawton (Chair) | | XChair

| X | |

Kristine A. Rappé | X | | Chair | |

Stephen J. Schmidt | | X | X | ChairCo-Chair

|

Derek L. Tyus | X | X | X | X

|

Douglas S. Gordon was appointed to the Executive Committee effective on January 5, 2024.

|

Audit Committee. The audit committee of Waterstone Financial (the “Audit Committee”) met tensix times during the year ended December 31, 2021.2023. The board of directors has determined that each member of the Audit Committee meets not only the independence requirements applicable to the committee as prescribed by the NASDAQ corporate governance listing standards, but also by the Securities and Exchange Commission. On behalf of the Audit Committee, Mr. Hansen, its chair, also regularly consults with Waterstone Financial’s independent registered public accounting firm about Waterstone Financial’s periodic public financial disclosures. The board believes that all of the members of the Audit Committee have sufficient experience, knowledge and other personal qualifications to be “financially literate” and to be active, effective and contributing members of the Audit Committee. Mr. Hansen has been designated an “audit committee financial expert” pursuant to the Sarbanes-Oxley Act of 2002 and the Securities and Exchange Commission regulations. See also “Report of the Audit Committee” for other information pertaining to the Audit Committee.

Compensation Committee. The compensation committee of Waterstone Financial (the “Compensation Committee”) held tenseven meetings during the year ended December 31, 2021.2023. Each member of the Compensation Committee is considered independent as defined in the NASDAQ corporate governance listing standards. The Compensation Committee has the responsibility for and authority to either establish or recommend to the board: compensation policies and plans; salaries, bonuses and benefits for all officers; salary and benefit levels for employees; determinations with respect to stock options and restricted stock awards; and other personnel policies and procedures. The Compensation Committee has the authority to delegate the development, implementation and execution of benefit plans to management. See also “Compensation Discussion and Analysis” and “Compensation Committee Interlocks and Insider Participation” for other information pertaining to the Compensation Committee.

Executive Committee. The executive committee of Waterstone Financial (the “Executive Committee”) held 11 meetings during the year ended December 31, 2023. The Executive Committee has the responsibility to review and/or approve certain loans made or to be made by the Bank in accordance with the Bank’s Lending Policy. The Executive Committee reviews loan submissions, communicate requests for additional information, and promptly communicate the approval or disapproval of a loan to management.

Nominating and Corporate Governance Committee. The nominating and corporate governance committee (“Nominating Committee”) of Waterstone Financial held two meetingsone meeting during the year ended December 31, 2021.2023. Each member of the Nominating Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards.

The functions of the Nominating Committee include the following:

| ● | to lead the search for individuals qualified to become members of the board of directors and to select director nominees to be presented for shareholder approval; |

| | ● | to leadreview and monitor compliance with the searchrequirements for individuals qualified to become members of the board of directors and to select director nominees to be presented for shareholder approval;independence; |

| | ● | to review the committee structure and monitor compliance withmake recommendations to the requirements for board independence;of directors regarding committee membership; and |

| ●

| to review the committee structure and make recommendations to the board of directors regarding committee membership; and

|

| | ● | to develop and recommend to the board of directors for its approval a set of corporate governance guidelines. |

The Nominating Committee identifies nominees by first evaluating the current members of the board of directors willing to continue in service. Current members of the board of directors with skills and experience that are relevant to our business and who are willing to continue in service are first considered for re-nomination, balancing the value of continuity of service by existing members of the board of directors with that of obtaining new perspectives. If any member of the board of directors does not wish to continue in service, or if the committee or the board decides not to re-nominate a member for re-election, the Nominating Committee may solicit suggestions for director candidates from all directors.

Board Diversity. The Boardboard believes that the Company and its shareholders are best served by having a Board of Directors that brings a diversity of education, experience, skills and perspective to Board meetings. While these attributes are considered on an ongoing basis, the Nominating and Corporate Governance Committee and the Board of Directors will particularly consider such diversity in the recruitment and deliberation regarding prospective director nominees.

Board Qualifications. Qualifications of director candidates are described in the Appendix to the Nominating and Corporate Governance Committee Charter, which can be found on our website, at www.wsbonline.com, on the “Investor Relations” link under the “About” tab, then “Corporate Overview” and “Governance Documents.” Factors considered include strength of character, honesty and integrity, an inquiring and independent mind, judgment, skill, diversity, education, experience with businesses and other organizations, the interplay of the candidates’ experience with the experience of other board members and the extent to which the candidate would be a desirable addition to the board and its committees. Nominees must have a background which demonstrates an understanding of business and financial affairs and the complexities of a business organization. Although a career in business is not essential, the nominee should have a proven record of competence and accomplishments through leadership in industry, education, the professions or government. Areas of core competency that should be represented on the board as a whole include accounting and finance, business judgment, management, crisis response, industry knowledge, leadership and strategic vision.

Director Election Voting Standard. A nomineefor director shall be elected to the Board if he or she receives approval on a plurality of votes cast.Since our organization as a Company, we have not yet had a director elected by less than a majority of the votes cast. Given our plurality voting standard, the Board is committed to conducting extensive shareholder outreach to understand any concerns, in the event that a director nominee fails to receive majority support in any future election.

Board Term or Age Limits. The Board does not currently employ formal term or age limits with respect to Board service. Rather than instituting a formal term or age limit, the Board employs an annual assessment to measure how well the skills of board members align with the current strategy of the Company. The foundation of this assessment is summarized in a Director Skills Matrix (detailed below).

Board Evaluation. The Board views the process of collective and individual self-assessment as an opportunity to enhance multiple dimensions of board effectiveness and strengthen governance practices. Currently, this evaluation process takes place in an informal manner before, during and after Board and Committee meetings.The Board is in the process of developing a framework for an annual assessment process that will be utilized to perform evaluations at a Board, Committee and/or Director level.Further, the Board is committed to expanding disclosures in future proxy statements to demonstrate the rigor of the board evaluation process.

Director Skills, Experience and Demographics Matrix. The following matrix provides information about the board of directors, including certain types of knowledge, skills, experience and other attributes possessed by one of more of them which the Board believes are relevant to the Company’s business and industry. The matrix does not capture all of the knowledge, skills and experiences possessed by the directors, and the Board believes that each director has the ability to contribute to the decision-making process in every area listed.

| | Bartel | Gordon | Hansen | Lawton | Rappé | Schmidt | Tyus | Bartel | Gordon | Hansen | Lawton | Rappé | Schmidt | Tyus | |

Knowledge, Skills and Experience | | | | | | | | | | | | | | | |

Financial Industry | | ● | ● | ● | | | ● | | ● | ● | ● | | | ● | |

Risk Management | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

Accounting | ● | ● | ● | | ● | | ● | ● | ● | ● | | ● | | ● | |

Corporate Governance/Ethics | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

Legal/Regulatory | | ● | ● | ● | ● | | ● | | ● | ● | ● | ● | | ● | |

HR/Compensation | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

Executive Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

Investments | | ● | ● | ● | ● | ● | ● | | ● | ● | ● | ● | ● | ● | |

Operations | ● | ● | ● | ● | ● | ● | | ● | ● | ● | ● | ● | ● | | |

Strategic Planning | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

Technology/Cyber | | ● | ● | | ● | | | | ● | ● | | ● | | | |

Mergers and Acquisitions | | ● | ● | | | | ● | | ● | ● | | | | ● | |

Crises Response | ● | ● | ● | ● | ● | ● | | |

| | | | | | | | | |

Race/Ethnicity | | | | | | | | |

Crisis Response | | ● | ● | ● | ● | ● | ● | | |

Demographic Background | | | | | | | | | |

African American | | | | | | | ● | | | | | | | ● | |

Alaskan Native or Native American | | | | | | | | | |

Asian | | | | | | | | | |

Hispanic | | | | | | | | | |

Native Hawaiian or Pacific Islander | | | | | | | | | |

White/Caucasian | ● | ● | ● | ● | ● | ● | | ● | ● | ● | ● | ● | ● | | |

Two or More Races or Ethnicities | | | | | | | | | |

LGBTQ+ | | | | | | | | | |

Gender | | | | | | | | | | | | | | | |

Female | ● | | | | ● | | | ● | | | | ● | | | |

Male | | ● | ● | ● | | ● | ● | | ● | ● | ● | | ● | ● | |

Non-Binary | | | | | | | | | |

Board Tenure | | | | | | | | | | | | | | | |

Years on Waterstone Financial Inc. | 7 | 16 | 16 | 16 | 7 | 16 | 2 | 9 | 18 | 18 | 18 | 9 | 18 | 4 | |

Years on WaterStone Bank | 8 | 16 | 18 | 21 | 8 | 19 | 2 | |

The Nominating Committee will also take into account whether a candidate satisfies the criteria for “independence” under the NASDAQ corporate governance listing standards and, if a nominee is sought for service on the Audit Committee, the financial and accounting expertise of a candidate, including whether an individual qualifies as an “audit committee financial expert.”

The Nominating Committee will consider proposed nominees whose names are submitted to it by shareholders, and it does not intend to evaluate proposed nominees differently depending upon who has made the proposal. Shareholders can submit the names of qualified candidates for director by writing to our Corporate Secretary at 11200 W. Plank Ct., Wauwatosa, Wisconsin 53226. The Corporate Secretary must receive a submission not earlier than the 90th day nor later than the 80th day prior to date of the annual meeting; provided, however, that in the event that less than 90 days’ notice or prior public disclosure of the date of the annual meeting is provided to shareholders, then, to be timely, notice by the stockholder must be so received not later than the tenth day following the day on which public announcement of the date of such meeting is first made. The submission must include the following information:

| | ● | ●a statement that the writer is a shareholder and is proposing a candidate for consideration by the Nominating Committee;

| a statement that the writer is a shareholder and is proposing a candidate for consideration by the Nominating Committee;

|

| | ● | the name and address of the shareholder as they appear on our books and number of shares of our common stock that are owned beneficially by such shareholder (if the shareholder is not a holder of record, appropriate evidence of the shareholder’s ownership will be required); |

| ● | the name, address and contact information for the candidate, and the number of shares of common stock that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the shareholder’s ownership willshould be required)provided); |

| | ● | a statement of the name, addresscandidate’s business and contacteducational experience; |

| ● | such other information forregarding the candidate as would be required to be included in the Proxy Statement pursuant to Securities and the number of shares of common stock that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the shareholder’s ownership should be provided);Exchange Commission Regulation 14A; |

| | ● | a statement ofdetailing any relationship between us and the candidate’s business and educational experience;candidate; |

| ●

| such other information regarding the candidate as would be required to be included in the Proxy Statement pursuant to Securities and Exchange Commission Regulation 14A;

|

| | ● | a statement detailing any relationship between usthe candidate and the candidate;any of our customers, suppliers or competitors; |

| | ● | a statement detailingdetailed information about any relationship or understanding between the candidateproposing shareholder and any of our customers, suppliers or competitors;the candidate; and

|

| ●

| detailed information about any relationship or understanding between the proposing shareholder and the candidate; and

|

| | ● | a statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected. |

A nomination submitted by a shareholder for presentation at an annual meeting of shareholders will also need to comply with any additional procedural and informational requirements we may adopt in the future, including those set forth in our Bylaws and in the “Shareholder Proposals and Notices” section of this Proxy Statement.

Waterstone Financial has adopted charters for the Audit, Compensation and Nominating Committees. We will continue to respond to and comply with Securities and Exchange Commission and NASDAQ Stock Market requirements relating to board committees. Copies of the charters for our Audit, Compensation and Nominating Committees (including director selection criteria) and other corporate governance documents can be found on our website, at www.wsbonline.com, on the “Investor Relations” link under the “About” tab, then “Corporate Overview” and “Governance Documents.” If any of those documents are changed, or related documents adopted, those changes and new documents will be posted on our corporate website at that address.

Other Board and Corporate Governance Matters

Board Leadership Structure and Risk Oversight Role. The role of chairman of the board of directors and chief executive officer of the Company are not currently held by the same person. The chairman of the board has never been an officer or employee of the Company or WaterStone Bank. The foregoing structure is not mandated by any provision of law or our Articles of Incorporation or Bylaws, but the board of directors currently believes that this structure provides for an appropriate balance of authority between management and the board. The board of directors reserves the right to establish a different structure in the future.

The board of directors of the Company, all of the members of which are also members of the board of directors of WaterStone Bank, is actively involved in the Company’s and Bank’s risk oversight activities, through the work of numerous committees of the Company and Bank, and the policy approval function of the board of directors of WaterStone Bank.

Communications Between Shareholders and the BoardShareholder Communication. We are committed to open and ongoing dialog with our shareholders and we regularly seek feedback on a variety of issues, including business strategy, governance, executive compensation and any other topics shareholders wish to discuss. To this end, we engage with our shareholders in a variety of ways in order to obtain their feedback. In addition to shareholder outreach, the Board of Directors welcomes communication from our shareholders. A shareholder who wants to communicate with the board of directors or with any individual director can write to our Corporate Secretary at 11200 W. Plank Ct., Wauwatosa, Wisconsin 53226, Attention: Board Administration. The letter should indicate that the author is a shareholder and if shares are not held of record, should include appropriate evidence of stock ownership. Depending on the subject matter, management will:

| ● | forward the communication to the director or directors to whom it is addressed; |

| | ● | forwardattempt to handle the communication to the director or directors to whominquiry directly, i.e. where it is addressed;a request for information about us or it is a stock-related matter; or

|

| | ● | attempt to handlenot forward the inquiry directly, i.e. wherecommunication if it is a request for information about usprimarily commercial in nature, relates to an improper or itirrelevant topic, or is a stock-related matter;unduly hostile, threatening, illegal or

|

| ● otherwise inappropriate.

| not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate.

|

At each board meeting, management shall present a summary of all communications received since the last meeting that were not forwarded and make those communications available to the directors.

Board Involvement in Risk Management Process. As part of its overall responsibility to oversee the management, business, and strategy of the Company., one of the primary responsibilities of our Board of Directors is to oversee the amounts and types of risk taken by management in executing the corporate strategy, and to monitor our risk experience against the policies and procedures set to control those risks. The Board’s risk oversight function is carried out through its approval of various policies and procedures, such as our lending and investment policies; ratification or approval of investments and loans exceeding certain thresholds; and regular review of risk elements such as interest rate risk exposure, liquidity, and problem assets. Some oversight functions are delegated to committees of the Board, with such committees regularly reporting to the full Board the results of their oversight activities. For example, the Audit Committee is responsible for oversight of the independent registered public accounting firm and meets directly with the firm at various times during the course of the year.

Board Oversight of Information and Cybersecurity. As a financial institution, cybersecurity presents a significant operational and reputational risk. Accordingly, we take the protection of customer and business information very seriously. We have developed a robust information/cyber security program designed to protect the confidentiality, integrity, and availability of business and customer information. As part of this program, our Chief Information Officer reports to the Board of Directors on a regular basis. Reports include information and cyber security assessment results, business continuity, disaster recovery, and incident response planning and testing, vendor management program status, and independent audit results. All information security-related policies are reviewed and approved annually by the Board.

We promote a culture of continuous learning that has resulted in a highly experienced information security team. In addition to our own experienced information security team, we also partner with industry experts for managed security services such as threat intelligence, firewall, intrusion detection, and intrusion prevention services to ensure protection around the clock. Highlights of the information and cybersecurity program include the following:

| ● | strong vendor oversight; |

| ● | deployment of defense-in-depth strategy with multiple layers of controls to provide information protection; |

| ● | engagement of third-party audit firms to conduct independent security assessments that include vulnerability assessments and penetration tests; |

| ● | conduct of new and ongoing security awareness training (as well as intermittent testing) for all teammates across the |

| ● | follow all Federal Deposit Insurance Corporation and Nasdaq requirements for disclosure of security breaches organization. |

Director Attendance at Annual Shareholders’ Meeting. Although we do not have a formal policy regarding director attendance at the annual meeting, we encourage all of our directors to attend. Last year the seven directors serving at that time were present at the annual meeting.

Code of Business Conduct and Ethics. Waterstone Financial has adopted a code of business conduct and ethics that reflects current circumstances and Securities and Exchange Commission and NASDAQ definitions for such codes. The code of business conduct and ethics covers us, WaterStone Bank and other subsidiaries. Among other things, the code of business conduct and ethics includes provisions regarding honest and ethical conduct, conflicts of interest, full and fair disclosure, compliance with law, and reporting of and sanctions for violations. The code applies to all directors, officers and employees of Waterstone Financial and subsidiaries. We have posted a copy of the code of business conduct and ethics on our website, at www.wsbonline.com, on the “Investor Relations” link under the “About” tab, then “Corporate Overview” and “Governance Documents.” As further matters are documented, or if those documents (including the code of business conduct and ethics) are changed, waivers from the code of business conduct and ethics are granted, or new procedures are adopted, those new documents, changes and/or waivers will be posted on the corporate website at that address.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Waterstone Financial board of directors was created in accordance with Section 3(a)(58)(a) of the Securities Exchange Act.Act of 1934, as amended (the “Exchange Act”). The Audit Committee’s functions include meeting with our independent registered public accounting firm and making recommendations to the board regarding the independent registered public accounting firm; assessing the adequacy of internal controls, accounting methods and procedures; review of public disclosures required for compliance with securities laws; and consideration and review of various other matters relating to the our financial accounting and reporting. No member of the Audit Committee is employed by or has any other material relationship with us other than as a customer or shareholder. The members are “independent” as defined in Rule 5605(a)(2) of the NASDAQ listing standards. The board of directors has adopted a written charter for the Audit Committee which can be found on our website.

In connection with its function to oversee and monitor our financial reporting process, the Audit Committee has done the following:

| | ● | reviewed and discussed the audited financial statements for the year ended December 31, 20212023 with management; |

| | ● | discussed with CliftonLarsonAllenFORVIS LLP, our independent registered public accounting firm, those matters which are required to be discussed under the applicable standards of the applicable standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”); and |

| | ● | received the written disclosures and the letter from CliftonLarsonAllenFORVIS LLP required by the PCAOB and has discussed with CliftonLarsonAllenFORVIS LLP its independence. |

The Audit Committee:

Michael L. Hansen, Chairman

Ellen S. Bartel

Thomas E. Dalum

Kristine A. Rappé

Derek L. Tyus

The information contained in the above report will not be deemed to be “soliciting material” or “filed” with the SEC, nor will this information be incorporated into any future filing under the Securities Act of 1933, as amended, (the “Securities Act”), or the Exchange Act except to the extent the Company specifically incorporates such report by reference.

Based on the foregoing, the Audit Committee recommended to the board that those audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2021.2023. In addition, the Audit Committee also considered the fees paid to CliftonLarsonAllenFORVIS LLP for services provided by CliftonLarsonAllenFORVIS LLP during the year ended December 31, 2021.2023.

PROPOSAL 2 – RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The firm of CliftonLarsonAllenFORVIS LLP has audited the financial statements of Waterstone Financial as of and for the year ended December 31, 20212023 and hashad served as Waterstone Financial’s principal independent accountant since 2021. Representatives of CliftonLarsonAllen LLP are expected to be present at the annual meeting to respond to appropriate questions and to make a statement if they so desire.2023.

The Audit Committee of the Board of Directors has selected CliftonLarsonAllenFORVIS LLP as our independent registered public accountants for the fiscal year ending December 31, 2021.2023. We are submitting the selection of independent registered public accountants for shareholder ratification at the annual meeting. Although not required by the Company’s Articles of Incorporation or Bylaws, the Company has determined to ask shareholders to ratify this selection as a matter of good corporate practice. If the appointment of CliftonLarsonAllenFORVIS LLP is not ratified, the Audit Committee will consider the shareholders’ vote when determining whether to continue the firm’s engagement, but may ultimately determine to continue the engagement of the firm or another audit firm without re-submitting the matter to shareholders. Even if the appointment of CliftonLarsonAllenFORVIS LLP is ratified, the Audit Committee may in its sole discretion terminate the engagement of the firm and direct the appointment of another independent registered public accounting firm at any time during the year if it determines that such an appointment would be in the best interests of our Company and our shareholders.

RSM USCliftonLarsonAllen LLP was previously the principal accountants for Waterstone Financial, Inc. On May 27, 2021January 17, 2023, CliftonLarsonAllen, Waterstone Financial, Inc.’s independent registered public accountant, informed the firmCompany that CliftonLarsonAllen would decline to stand for re-appointment after completion of the audit for the year ended December 31, 2022, as a result of CliftonLarsonAllen’s determination to cease providing certain audit services to SEC registrants upon completion of the 2022 audit cycle. On February 28, 2023, CliftonLarsonAllen completed its audit of the Company’s consolidated financial statements as of and for the year ended December 31, 2022. Accordingly, as of February 28, 2023, CliftonLarsonAllen was dismissed as Waterstone Financial's principal accountants. The decision to dismiss RSM US LLP was approved byno longer the Audit Committee of Waterstone Financial.Company’s independent registered public accountant.

DuringCliftonLarsonAllen’s audit reports on the Company’s consolidated financial statements as of and for the years ended December 31, 20202022 and 20192021 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the subsequent interim period through May 27,fiscal years ended December 31, 2022 and 2021, there were no: (1) disagreements with RSM US LLPCliftonLarsonAllen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to their satisfaction, would have caused them to make reference in connection with their opinion to the subject matter of the disagreement, or (2) reportable events under Item 304(a)(1)(v) of Regulation S-K.

The audit reports of RSM US LLPAs previously disclosed on the consolidated financial statements of Waterstone Financial as of and for the years ended December 31, 2020 and 2019 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles.

A letter from RSM US LLP addressed to the Securities and Exchange Commission stating whether it agrees with the above statements was filed as an exhibit to Waterstone Financial's Report on Form 8-K filed with the Securities and Exchange Commission on June 2, 2021.

On June 2, 2021, Waterstone Financial engaged CliftonLarsonAllen LLP as Waterstone Financial’s new principal accountants for the year ending December 31, 2021. The engagement was approved byJanuary 17, 2023, the Audit Committee of the Board of Directors of Waterstone Financial. DuringFinancial, Inc. approved the years endedappointment of FORVIS LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2020 and 2019, and2023 after a competitive request for proposal process. The appointment of FORVIS LLP was effective upon completion of the subsequent interim period prioraudit of the Company’s consolidated financial statements for the fiscal year ending December 31, 2022 by CliftonLarsonAllen, which occurred on February 28, 2023. Prior to retaining FORVIS LLP, neither the engagement of CliftonLarsonAllenCompany nor anyone acting on its behalf consulted with FORVIS LLP Waterstone Financial did not consult with CliftonLarsonAllen LLP regardingrespect to any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of Regulation S-K.

As reflected in the tables below, Waterstone Financial incurred fees in fiscal year 2021 for professional services provided by CliftonLarsonAllen LLP related to that period. Waterstone Financial incurred fees in fiscal years 2021 and 2020 for professional services provided by RSM US LLP related to such periods.

As reflected in the tables below, Waterstone Financial incurred fees in fiscal years 20212023 and 20202022 for professional services provided by CliftonLarsonAllen LLP and RSM US LLP related to those periods.

| | | Year Ended | |

CliftonLarsonAllen LLP | | December 31, 2021 | | | December 31, 2020 | |

| | | | | | | | | |

Audit fees(1) | | $ | 299,500 | | | $ | - | |

Audit-related fees(2) | | $ | 24,098 | | | $ | 22,995 | |

| | | Year Ended | |

FORVIS LLP | | December 31, 2023 | | | December 31, 2022 | |

| | | | | | | | | |

Audit fees(1)…………… | | $ | 356,499 | | | $ | - | |

Audit-related fees(2)…… | | $ | 60,270 | | | $ | - | |

_____________________ | | | | | | | | |

| (1)

| Audit fees consist of professional services rendered for the audit of our consolidated financial statements and review of SEC Filings. Audit fees also include professional fees rendered for the audit of the stand–alone financial statements of Waterstone Mortgage Corporation.

|

| (2)

| Audit-related fees consisted of audit of the Company’s 401K and ESOP Plan audits.

|

| | | Year Ended | |

RSM US LLP | | December 31, 2021 | | | December 31, 2020 | |

| | | | | | | | | |

Audit fees(1) | | $ | 59,640 | | | $ | 393,695 | |

Audit-related fees(2) | | $ | 10,500 | | | $ | - | |

| | (1) | Audit fees consist of professional services rendered for the audit of our consolidated financial statements and review of SEC Filings and consent on Form S-8.Filings. Audit fees also include professional fees rendered for the audit of the stand–alone financial statements of Waterstone Mortgage Corporation. |

| | (2) | Audit-related fees consistconsisted of fees for the audit transition to a new firm.tax compliance fees. |

| | | Year Ended | |

CliftonLarsonAllen LLP | | December 31, 2023 | | | December 31, 2022 | |

| | | | | | | | | |

Audit fees(1)…………. | | $ | - | | | $ | 309,254 | |

Audit-related fees(2)… | | $ | 28,140 | | | $ | 10,500 | |

_____________________ | | | | | | | | |

(1) Audit fees consist of professional services rendered for the audit of our consolidated financial statements and review of SEC Filings. Audit fees also include professional fees rendered for the audit of the stand–alone financial statements of Waterstone Mortgage Corporation.

(2) Audit-related fees consisted of the transition and consent on Form S-8 in the 10-k.

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services of the Independent Registered Public Accounting Firm

The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The Audit Committee has delegated pre-approval authority to its Chairman when expedition of services is necessary. The independent registered public accounting firm and management are required to periodically report to the full Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. All audit services for the past two fiscal years were pre-approved by the Audit Committee.

COMPENSATION DISCUSSION AND ANALYSIS

Overview of Compensation Program

Executive Summary. The Compensation Committee provides our Named Executive Officers with a total compensation package that is market competitive, promotes the achievement of our strategic objectives and is aligned with operating and other performance metrics to support long-term shareholder value. In addition, we have structured our executive compensation program to include elements that are intended to create appropriate balance between risk and reward.

Compensation Philosophy. The primary objectives of our executive compensation programs are to attract and retain highly-qualified executives and to encourage extraordinary management efforts through well-designed incentive opportunities, with the goal of improving the performance of Waterstone Financial, Inc. and its subsidiaries consistent with the interests of our shareholders. We base our compensation decisions on three basic principles:

| ● | Meeting the Demands of the Market – We compensate our employees at competitive levels that position us as the employer of choice among our peers who provide similar financial services in the markets we serve. |

| | ● | Meeting the Demands of the MarketAligning with Shareholders – We compensateuse equity compensation as a key component of our employees at competitive levels that position us as the employercompensation mix to promote a culture of choiceownership among our peers who provide similarkey personnel and to align their individual financial services ininterests with the markets we serve.

|

| ●

| Aligning with Shareholders – We use equity compensation as a key componentlong-term interests of our compensation mix to promote a culture of ownership among our key personnel and to align their individual financial interests with the long-term interests of our shareholders.

|

| | ● | Driving Performance – We base compensation in part on the attainment of company-wide, business unit and individual performance targets that result in the achievement of both short-term and long-term financial objectives, while ensuring sound risk management. |

Elements of our Executive Compensation and Benefits Program. To achieve our objectives, we have structured an executive compensation program that provides our Named Executive Officers with the following:

| ● | Competitive Base Salary; |

| | ● | Competitive Base Salary;Short-Term Cash-Based Incentives;

|

| | ● | Short-Term Cash-Based Incentives;Equity Incentive Awards;

|

| | ● | Equity Incentive Awards;Broad-Based Welfare and Retirement Benefit Plans;

|

| | ● | Broad-Based WelfarePerquisites; and Retirement Benefit Plans;

|

The programs are intended to reward the accomplishment of strategic plan goals and objectives as evaluated by members of the Compensation Committee. They are further intended to reward enhanced shareholder value as measured by the trading price of our common stock. The elements of a Named Executive Officer’s total compensation package will vary depending upon the executive’s job position and responsibilities.

Compensation Polices and Highlights

Our compensation programs include, among others, the following best practices:

What We Do

| ✔ | The Compensation Committee has engaged an independent compensation consultant. |

| | ✔ | The Compensation Committee has engaged anis composed solely of independent compensation consultant.directors. |

| | ✔ | The Compensation Committee is composed solely of independent directors.We maintain stock ownership guidelines for our executive officers.

|

| | ✔ | We maintain stock ownership guidelines for our executive officers.non-employee directors. |

| | ✔ | We maintain stock ownership guidelinesclawback policies for our non-employee directors.incentive compensation. |

| | ✔ | We maintain a clawback policy for incentive compensation. |

| ✔

| We place restrictions on our directors and officers with respect to (i) holding Company securities in a margin account or otherwise pledging Company securities as collateral for a loan or (ii) engaging in a margin account or otherwise pledging Company securities as collateral for a loan or (ii) engaginghedging transactions in hedging transactions in the Company’s securities.

|

| | ✔ | We provide a say-on-pay advisory vote on an annual basis until the next required vote on the frequency of shareholder votes on executive compensation. |

What We Do Not Do

| ✖ | We do not encourage excessive risk-taking behavior through our compensation plans. |

| | ✖ | We do not encourage excessive risk-taking behavior through our compensation plans.reprice underwater stock options. |

| | ✖ | We do not reprice underwater stock options.grant options with an exercise price less than fair market value on date of grant. |

| ✖

| We do not grant options with an exercise price less than fair market value on date of grant.

|

| | ✖ | We do not provide excessive perquisitesprerequisites to our NEOs. |

| ✖ | We do not provide excise tax gross ups in our NEOs.compensation plans or employment agreements. |

| ✖ | We do not guarantee salary increases. |

| | ✖ | We do not provide excise tax gross ups in our compensation plans or employment agreements.for uncapped bonuses. |

| ✖

| We do not guarantee salary increases.

|

| | ✖ | We do not provide for uncapped bonuses. |

| ✖

| We do not provide for “single-trigger” benefits upon a change in control.

|

Shareholder Say-on-Pay Advisory Votes

We provide our shareholders with the opportunity to cast an annual advisory vote on executive compensation (a “say-on-pay proposal”). At our 20212023 annual meeting of shareholders, over 96%94% of the votes cast (excluding abstentions and broker non-votes) on the say-on-pay proposal at that meeting were voted in favor of the proposal.

We have held annual say-on-pay votes since 2010, and we will continue to hold annual say-on-pay votes until the next shareholders vote regarding the frequency of say-on-pay votes, which we expect to occur at the 2026 annual meeting of shareholders.

The Compensation Committee will continue to consider the outcome of our say-on-pay vote, regulatory changes and emerging best practices when making future compensation decisions for the Named Executive Officers.

Named Executive Officer Compensation Process, Programs and Polices